Succession solution through sale to leading, european healthcare investor

Successful succession solution in the med-tech sector: DZ BANK advises shareholders in a competitive, international bidding process

DZ BANK advises the shareholders of Acti-Med on the sales of the majority shares to Gilde Healthcare

Founded in 1997, Acti-Med is a leading international developer and manufacturer of tailor-made cannulas and cannula systems. The Freiensteinau-based, customer-centric med-tech company specializes on highly regulated products for pharmaceutical and medical applications, jointly developed with international OEMs. With locations in Freiensteinau (Germany) and Kozerkí (Poland), Acti-Med combines highest development and engineering capabilities, with superior quality and operational excellence on an international scale. Recent expansions into promising adjacent end markets, supported by innovative best-in-class products highlight the company’s continuous ambitions for quality and growth.

With the support of the new owner, Acti-Med will be able to strengthen and expand its product portfolio as well as market position as a high-quality supplier for leading med-tech and pharmaceutical companies both nationally and internationally. The founder will remain a minority shareholder and support the company in the transition period as part of the management team.

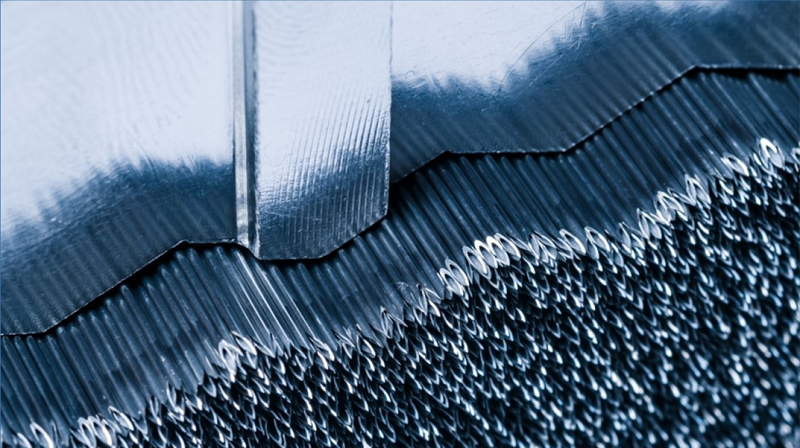

Quality control of cannula tips

Production of tube cannulas

The close collaboration with DZ BANK was based on a high level of trust and professionalism right from the beginning. Together with a deep understanding of the specific requirements of owner-managed medium-sized companies, DZ BANK demonstrated a high level of commitment, enthusiasm and an exceptional know-how in advising succession solutions in the medical technology sector. The excellent outcome, achieved by DZ BANK, justifies our confidence in every respect.